Property Assessment and Taxes

Taxation Authority and Administration

Under the authority of the First Nations Fiscal Management Act (FMA), WDFN implemented real property taxation laws which has enabled the First Nation to levy and collect annual property taxes in the same manner as other governments. Real property taxation provides the First Nation with a stable source of revenue which is reinvested to improve programs and services, quality of life, and community infrastructure to accommodate the continued growth at Whitecap.

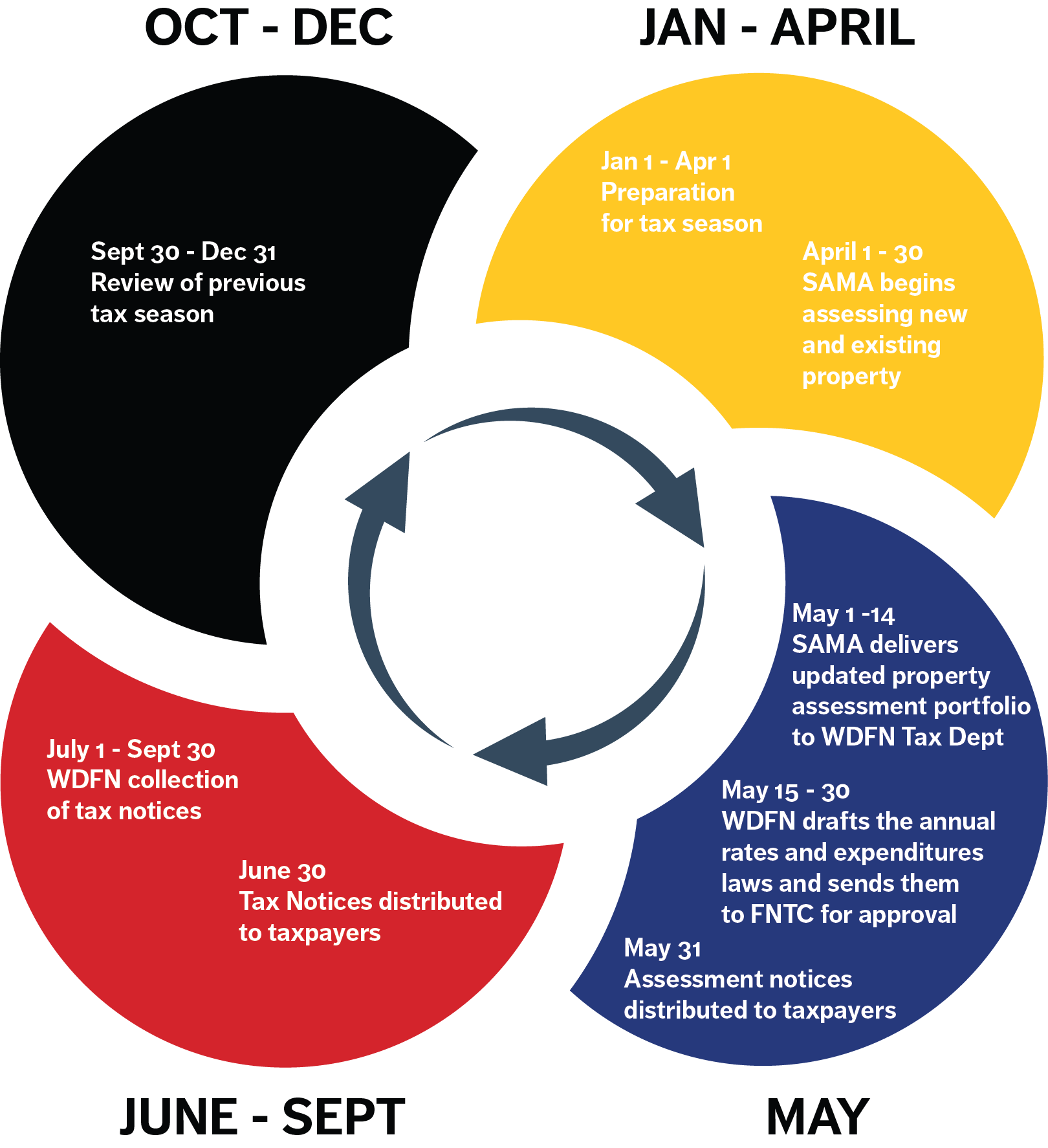

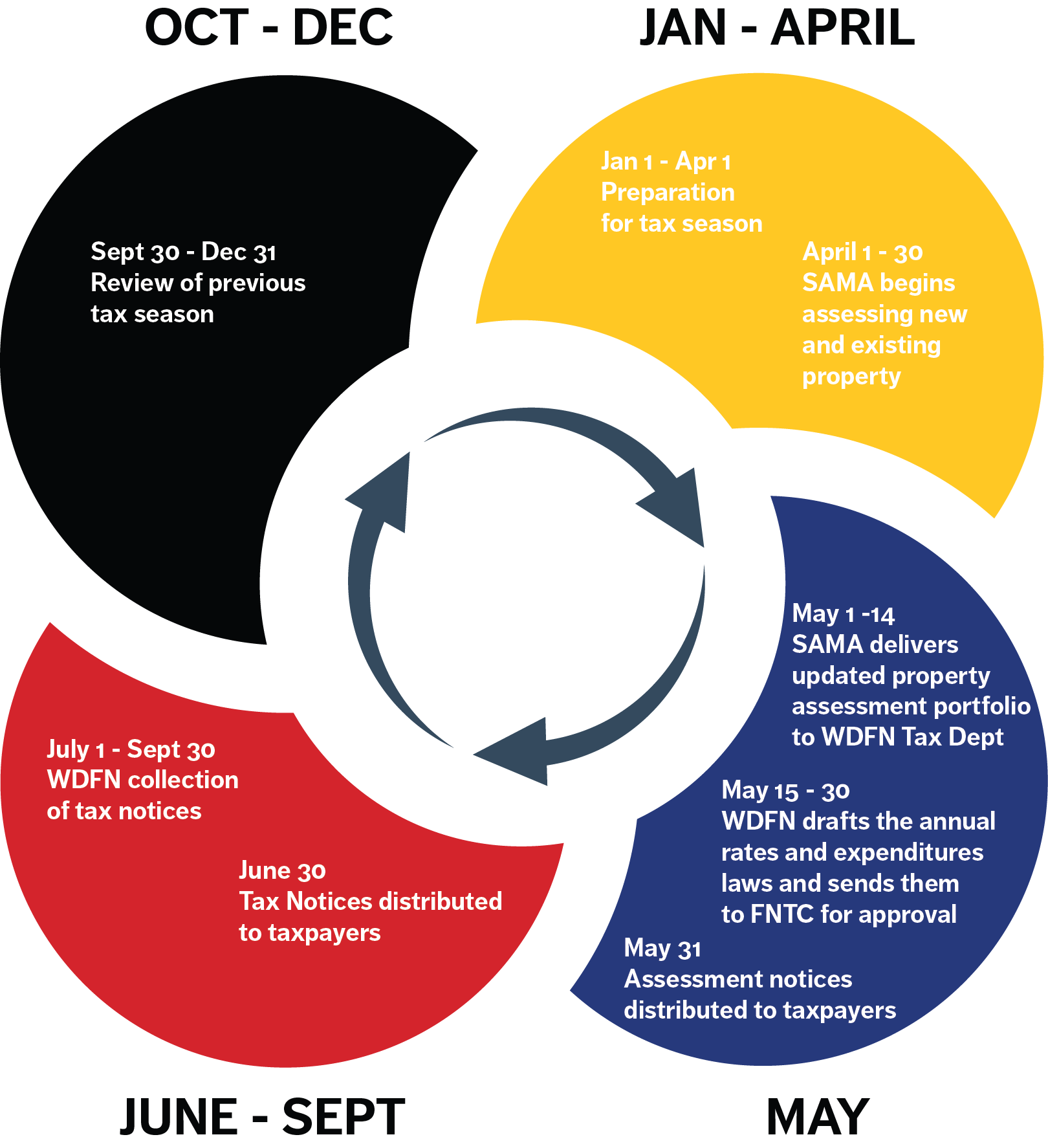

Property Assessments

Each year, the Saskatchewan Assessment Management Agency (SAMA) provides WDFN with up-to-date property assessments. Assessments represent the value of property for property tax purposes determined in accordance with legislation. SAMA provides the First Nation with tools to be successful with on-reserve assessments and consistency year after year. This contributes to taxpayer's confidence within the WDFN taxation system.

For more details please visit SAMA

2021 Tax Rates

| Property Class | Rate per $1,000 of Assessed Value |

|---|---|

|

Residential |

11.18 |

|

Multi-Unit Residential |

10.650 |

|

Commercial/Industrial |

11.8225 |

WDFN tax rates are set in accordance with the First Nations Tax Commission (FNTC) standards and are typically based on the First Nations budgetary requirements and the tax rates set out by adjacent local governments (reference jurisdictions). The Annual Tax Rates Law sets out the rates for each property class (ie. Residential, Commercial, Industrial) and is approved by the FNTC before enactment at the First Nation level to ensure accuracy, consistency and compliance under the FMA.

For more details please visit FNTC

WDFN Tax Laws:

- WDFN Property Taxation Law, 2012

- WDFN Property Assessment Law, 2012

- WDFN Development Levies Law, 2016

- WDFN Annual Expenditure Law, 2021

- WDFN Annual Rates Law, 2021

Contact Us

Whitecap Dakota Nation

182 Chief Whitecap Trail,

Whitecap, Saskatchewan

S7T 1G1

Phone: 306-477-0908

Fax: 306-374-5899

Sign up to our Newsletter

Stay up to date on the Nation's activities, events, programs and operations by subscribing to our eNewsletters.